No one plans to get sick or injured, but life has a way of disrupting even the best-laid plans. While most people insure their homes, vehicles, and even vacations, few stop to consider what would happen if they could no longer earn a living. In fact, a significant portion of the working population remains dangerously underinsured when it comes to income protection. Disability insurance for individuals is one of the most overlooked yet critical components of a sound financial plan—and it’s time more people started paying attention.

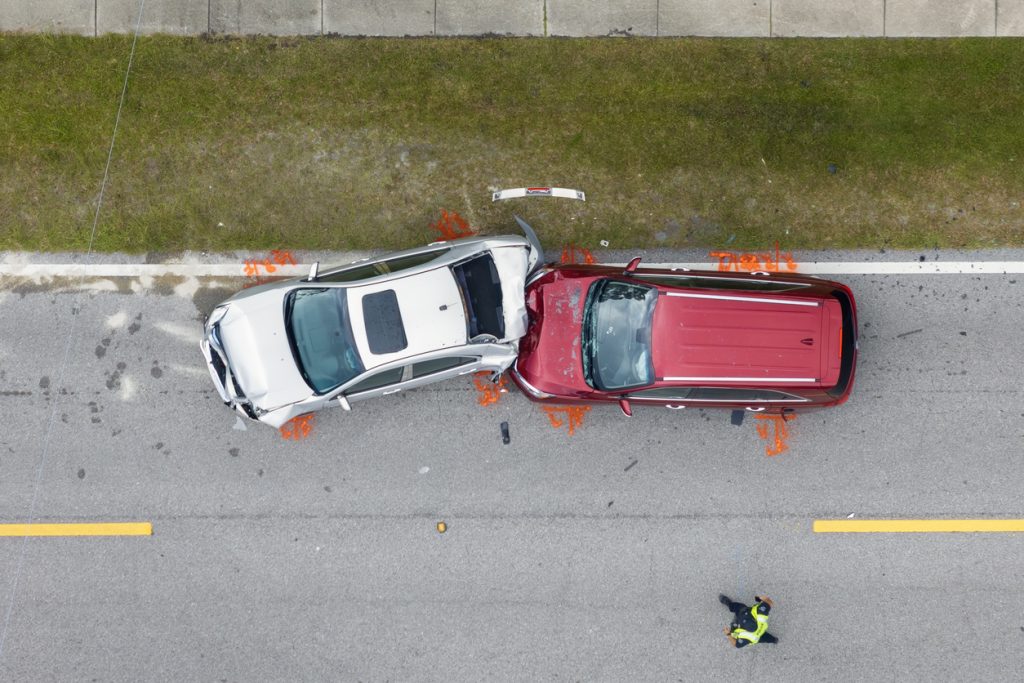

The reality is that disability doesn’t always mean a catastrophic accident. It can also mean a back injury, a chronic illness, or a mental health issue that prevents you from working for weeks, months, or even years. According to the Social Security Administration, more than one in four 20-year-olds will become disabled before reaching retirement age. That’s a staggering statistic, yet few individuals have a strategy in place to replace lost income in the event of the unexpected.

The Financial Toll of Being Uninsured

If you’re like most Americans, your lifestyle is largely shaped by your income. Mortgage payments, car loans, childcare, groceries, and retirement savings all depend on your ability to work. But without disability insurance for individuals, an injury or illness can quickly derail your financial stability. Savings may not last as long as expected, especially when coupled with rising healthcare costs. For many families, it takes just a few months without a paycheck to fall into serious debt or begin liquidating long-term assets.

Employer-provided short-term disability benefits—when available—often only last a few weeks and may not cover more than 60% of your base salary. Worse, some individuals are self-employed or work in high-income fields where employer plans don’t reflect actual earnings. That’s where individually owned disability insurance becomes essential. It ensures you can meet your obligations, support your loved ones, and maintain your quality of life, even when your ability to work is compromised.

Customized Coverage for Long-Term Peace of Mind

Unlike other types of insurance, disability insurance for individuals is highly customizable. Policies can be designed to replace a specific percentage of your income, include provisions for partial disability, or add coverage for cost-of-living adjustments. If you’re a high-earner, a professional in a specialized field, or self-employed, custom coverage allows you to protect not only your income but also your financial goals.

Tooher-Ferraris Insurance Group works closely with clients to structure policies around their profession, earnings, and lifestyle. Whether you’re a physician concerned about losing the ability to perform surgeries, a business owner with key responsibilities, or a consultant who depends on client-facing work, we help ensure your policy truly reflects the risks you face. And because disability often leads to additional financial strain—such as needing caregiving support or assistive equipment—it pairs well with long-term care insurance planning as part of a holistic protection strategy.

Protect Your Earning Power Before It’s Too Late

Your ability to earn an income is one of your most valuable assets, yet too many people leave it unprotected until it’s too late. With rising healthcare costs, limited government support, and the real risk of prolonged absence from work, disability insurance for individuals is no longer optional, it’s essential.

At Tooher-Ferraris Insurance Group, we help individuals and families protect what matters most. From customized disability coverage to complementary services like life insurance coverage and long-term care insurance planning, we offer solutions tailored to your life, career, and future goals. Let’s make sure your income and your future is fully protected.

Reach out today to discuss how we can help you build a stronger financial safety net.